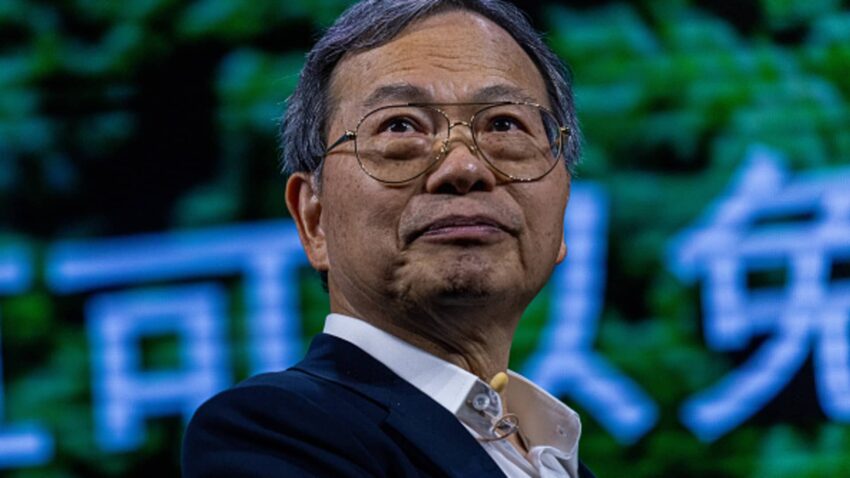

Tremendous Micro Laptop CEO Charles Liang on the Computex convention in Taipei, Taiwan, on June 5, 2024.

Annabelle Chih | Bloomberg | Getty Photographs

Tremendous Micro Laptop gave optimistic commentary for its fiscal 2026 and delayed annual report that overshadowed its slashed fiscal 2025 income steerage in Tuesday’s preliminary second-quarter outcomes.

CEO Charles Liang stated he’s “assured” that the corporate will file its delayed annual report by the U.S. Securities and Trade Fee’s Feb. 25 deadline. The corporate additionally stated it expects to hit $40 billion in income in fiscal 2026. Analysts polled by LSEG anticipated $30 billion in income for the interval.

Shares of Tremendous Micro have been up as a lot as 10% in prolonged buying and selling.

For the close to time period, nevertheless, the corporate slashed its steerage for fiscal 2025 income. The corporate stated it expects revenues to vary between $23.5 billion to $25 billion for fiscal 2025. That was down from a earlier forecast of $26 billion and $30 billion. Analysts polled by LSEG anticipated revenues of $24.9 billion for the yr.

The corporate additionally stated it expects to report internet gross sales between $5.6 billion and $5.7 billion for the quarter that ended Dec. 31. Wall Avenue anticipated $5.89 billion, in line with analysts polled by LSEG. The corporate additionally supplied weaker-than-expected steerage for the present interval.

Tremendous Micro additionally stated that it “continues to work diligently” to satisfy the deadline to file its delayed fiscal 2024 annual and financial 2025 first and second quarter reviews because it faces the opportunity of a Nasdaq delisting.

Shares of the corporate, recognized for its servers powered with Nvidia graphics processing chips, have been on a rollercoaster experience since Hindenburg Analysis revealed a brief place within the inventory and the corporate delayed releasing its annual report in August. The corporate’s auditor give up in October, citing governance points, and Tremendous Micro’s drop in share value spurred the opportunity of a delisting from the Nasdaq change.

The rollercoaster continued into Tuesday’s launch. The inventory is up about 27% in 2025 however down from its March 2024 excessive.

Tremendous Micro’s prime place within the synthetic intelligence world catapulted the inventory to new heights as ChatGPT’s 2022 debut set off a craze for AI infrastructure. Latest earnings reviews and commentary recommend that megacaps Meta, Amazon, Alphabet and Microsoft plan to speculate as a lot as $320 billion into AI tasks this yr.

WATCH: Tremendous Micro Laptop cuts full yr income steerage