China Information Service | China Information Service | Getty Photographs

The Trump administration’s commerce truce with China that paused the steepest tariffs on Chinese language items is not providing a lot of a reprieve to many importers. Stacking of a number of tariff layers already carried out in the course of the commerce battle has pushed up prices to import retail items a lot greater than the 30% related to the tentative settlement.

“Whereas corporations are relieved to see a short lived pause from the extremely excessive tariffs on items from China, retailers are nonetheless going through very excessive tariffs that can have an effect on costs and provide,” mentioned Josh Teitelbaum, senior counsel of Akin.

“A number of layers of tariffs are an enormous downside for fundamental objects like youngsters backpacks that come largely from China,” mentioned Dan Anthony, president at Commerce Partnership Worldwide. “You are speaking about charges of over 70%,” he mentioned.

That features the layering of present 17.6% tariffs and Part 301 tariffs (associated to unfair commerce practices) of 25%, with the 30% in tariffs on Chinese language items not included within the pause — 20% fentanyl-related tariffs and 10% reciprocal tariffs.

Walmart CFO John David Rainey mentioned in a CNBC interview after its earnings this week that costs of products together with meals, toys, and electronics could enhance on account of tariffs. “We’re attempting to navigate this the most effective that we are able to,” he mentioned within the CNBC interview. “However this can be a little bit unprecedented when it comes to the pace and magnitude through which the worth will increase are coming,” he added.

Panjiva knowledge exhibits from January 2025 to Could 12, Walmart’s prime three nations the place shipments originate from are China (34.1%), adopted by India (26.3%), and Hong Kong (10.6%).

For a lot of importers, the true tariff tax on Chinese language items now ranges from 40% to 70%.

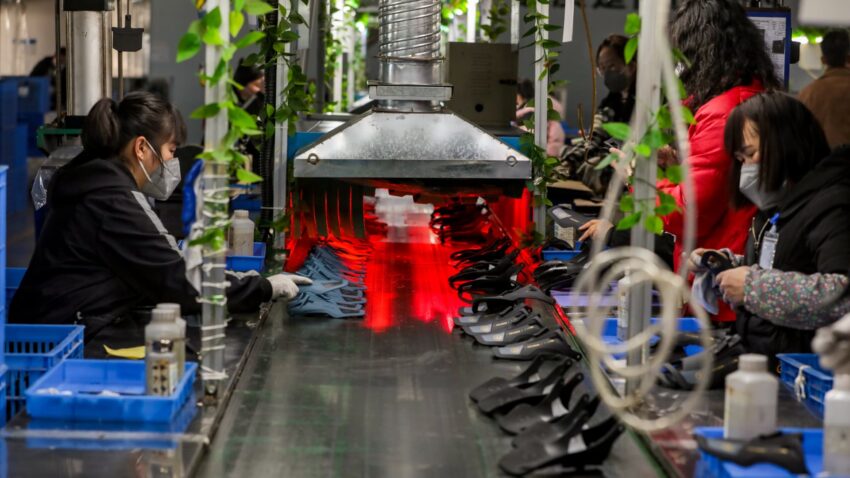

Teitelbaum supplied footwear for example, with a kids’s or girls’s sneaker that has a leather-based higher going through a 40% tariff if imported from China at the moment, factoring within the “most favored nation” customary tariff underneath WTO guidelines of 10%, plus the 30% in fentanyl and reciprocal tariffs.

That stacking of tariffs pushes the true price for a lot of different retail items a lot greater than 30%, together with:

- Cotton sweaters from China face a 46.5% tariff (16.5% most favored nation plus the fentanyl and reciprocal tariffs).

- Ladies’s bathing fits from China face a tariff of 54.9% (24.9% most favored nation plus the fentanyl and reciprocal tariffs).

- Child’s attire from China face a tariff of 41.5% (11.5% most favored nation plus the fentanyl and reciprocal tariffs).

Matt Priest, president & CEO of the Footwear Distributors & Retailers of America, instructed CNBC {that a} 40% tariff on the most well-liked class of imported girls’s and kids’s leather-based footwear is just unsustainable for American households and footwear corporations.

“These are on a regular basis sneakers — not luxurious objects — and making use of compounded tariffs on them solely drives up prices on the money register,” mentioned Priest. “With practically $650 million value of those sneakers imported from China final yr, it is clear this coverage disproportionately impacts working-class shoppers. It is time for a critical, bipartisan dialog about tariff reform that places American households first.”

This stacking of tariffs has led some small companies to chop product strains as a approach to mitigate the monetary pressure. Anjali Bhargava, founding father of spice firm Anjali’s Cup, says her firm can be discontinuing merchandise because the particular vacuum seal tins she makes use of promote out.

Even earlier than the 30% tariffs hit, she was paying 25% in tariffs. “These tins have been already dearer than I may afford, however even when I may take in the 30% tariff, as a small enterprise proprietor dealing with a lot by myself, I am unable to afford the added stress of uncertainty about how the story may change in the course of the months it might take to provide and ship the tins,” Bhargava mentioned. “The previous few months have been so destabilizing,” she added.

Bhargava mentioned it’s crucial to maximise the potential of the working capital she has out there and decrease pointless dangers, given how costly debt has change into. Bhargava’s line of credit score elevated in rate of interest to 23%, plus 2% to drag the cash.

“My bank card rates of interest are all within the excessive 20s so curiosity is a big difficulty and ordering tins 5 to 6 months earlier than I can promote them has been an enormous bottleneck,” Bhargava mentioned. “I used what I may to purchase the substances and packaging which are important for these merchandise and now I’ve to give attention to constructing a stronger basis for the corporate with these.”

Rick Woldenberg, CEO of Studying Assets, a family-owned firm that makes instructional toys and is suing the Trump administration over the tariffs — a listening to scheduled for Could 27 — is simply going through the 30% tariffs, however he mentioned the leap from zero to 30% is steep. Even when the pause does put his firm able of importing some objects once more, it comes at a excessive worth.

“A 30% responsibility charge, after we used to pay zero, is an enormous change in prices and can drive a big worth enhance to cowl it,” mentioned Woldenberg. “I consider this tax is extremely inflationary. We do not like the thought of collaborating in driving up inflation, so we’re hardly rejoicing over the information.”

He mentioned a ebook of completed items and work in progress in China that was a part of manufacturing orders due within the 45-60 days after Trump’s April 2 world tariffs announcement will possible be imported from Chinese language manufacturing facility companions. “We now can and possibly ought to relieve them of this stock and attempt to promote it right here. We’ll selectively restart manufacturing of notably delicate merchandise, for numerous causes, however resourcing continues and our migration away from China stays energetic,” Woldenberg mentioned.

The small enterprise homeowners all say the tariffs have taken a toll on the enterprise and their belief within the course of.

“We nonetheless do not know what our prices are or can be, and assume that future selections by this administration can be final minute, with out advance discover and trigger us additional ache and disruption. We’ve got no confidence wanting ahead,” Woldenberg mentioned.

Rick Muskat, president of family-owned shoe retailer Deer Stags, which imports its items from China and sells in main retailers together with Macy’s, Kohl’s, JCPenney, and on Amazon, mentioned even with the decreasing of the Chinese language tariffs, the stacking of all present tariffs has elevated exponentially.

“Even on the ‘decreased’ stage it will trigger critical cashflow issues,” mentioned Muskat. “We have been paying $60,000 monthly. Now we’re paying $360,000 monthly. We’ve got to chop bills to cowl this and discover financial savings in payroll. It is going to additionally require us to lift costs for future deliveries,” he mentioned.

“The injury of the previous weeks can’t be undone and might solely be addressed with some kind of long term assurances and stability that allow us to make the most effective selections on the best way to spend our cash at the moment, subsequent week and subsequent month, and set ourselves up for fulfillment sooner or later,” Bhargava mentioned. “I’ll survive and I am fairly optimistic that the enterprise will too, however the stress to determine it out has been tough and has taken a toll on me. I’ve wanted to essentially decelerate and never panic, however I am discovering my manner, step-by-step.”