Even probably the most meticulously deliberate tasks expertise unexpected adjustments, and when this occurs, we have to quantify the impact these adjustments have. Fortunately, there are formulation that eradicate the guesswork.

One in all these formulation solves for Estimate at Completion — an vital metric for monitoring a venture finances. Hold studying to be taught why to at all times calculate Estimate at Completion and precisely what this formulation can do.

What Is Estimate at Completion (EAC)?

Estimate at completion (EAC) is part of the earned worth administration (EVM) system. This time period refers back to the observe of re-estimating the full value of the venture throughout the venture execution section. In different phrases, EAC permits venture administration groups to forecast how a lot the venture will value on the time of completion primarily based on its precise prices, that are possible totally different from the prices within the venture finances made within the initiation or planning section.

As soon as calculated, the EAC can then be in comparison with the initially projected finances to find out if the venture is more likely to be completed inside finances primarily based on present efficiency.

Not like different strategies of value estimation, an estimate at completion calculation considers precise efficiency at any given second of the venture execution section and acknowledges that preliminary finances projections are possible not excellent. For that reason, it’s sometimes called a “venture forecasting device or methodology”

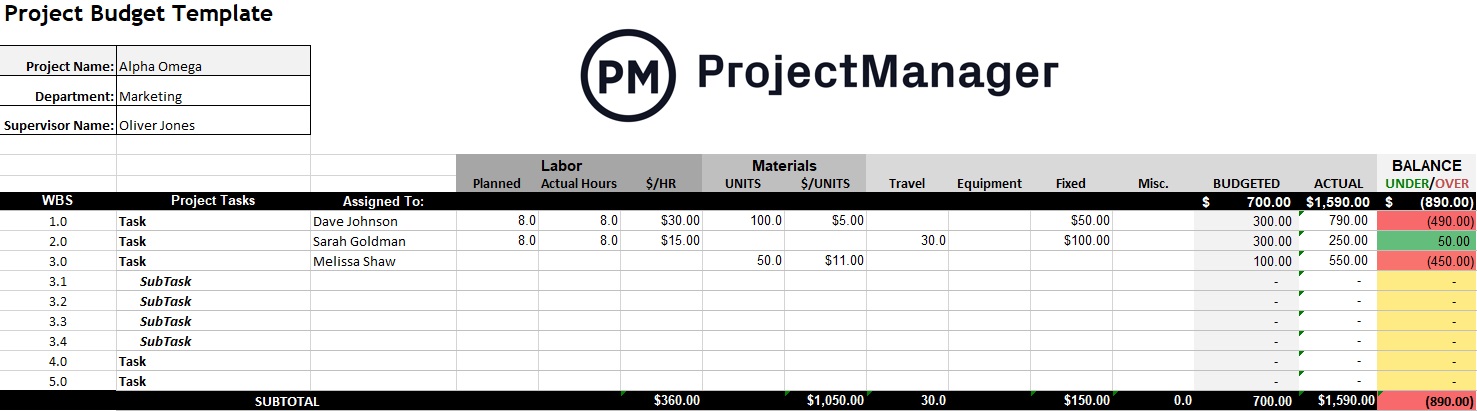

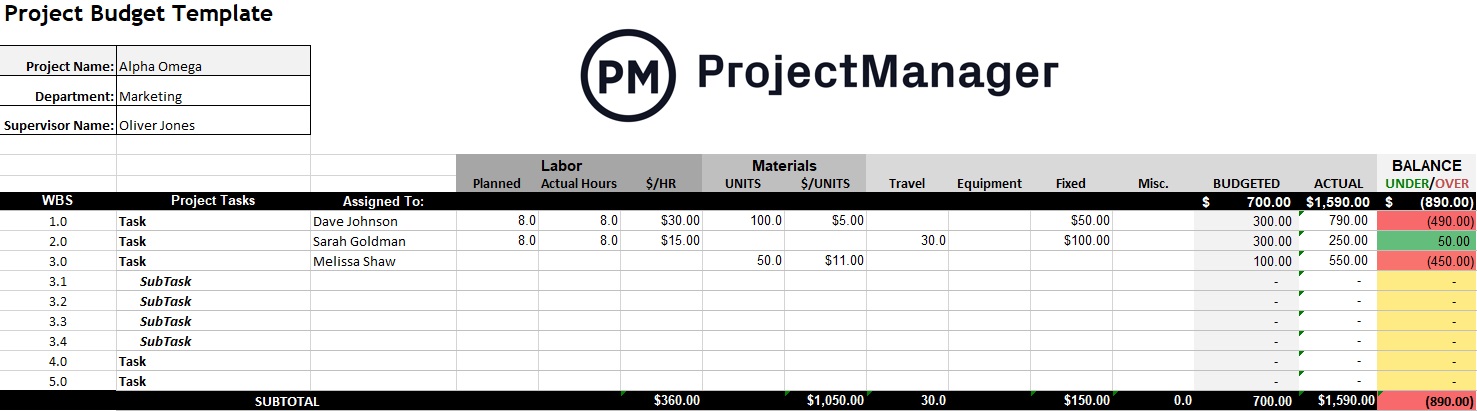

Get your free

Challenge Finances Template

Use this free Challenge Finances Template for Excel to handle your tasks higher.

To completely perceive the position EAC performs within the earned worth administration system, now we have to take a look at different components of this technique and the way EAC is exclusive.

Due to the dynamic nature of EAC, there is no such thing as a single formulation to calculate the estimate at completion of a venture, as you should use a number of formulation relying on how the venture is progressing. However earlier than we get into that, it’s vital to outline the variables which might be used to calculate EAC.

Estimate at Completion (EAC) Definitions

The estimate at completion formulation consists of variables and ideas which might be a part of the Earned Worth Administration system. However what precisely do these phrases imply and the way do you discover them?

- Finances at Completion (BAC): Finances at Completion (BAC) refers back to the whole finances required to finish a venture. To be able to discover BAC, it’s essential to add all estimated prices and bills. Usually, budgets are damaged down categorically. BAC is the sum of all of the classes.

- Value Efficiency Index (CPI): Value Efficiency Index (CPI) is a ratio representing how prices are being was precise work; how successfully is cash being spent. That is discovered by dividing the earned worth (EV) of labor accomplished by the Precise Value (AC) it took to carry out.

- Schedule Efficiency Index (SPI): Much like CPI, the Schedule Efficiency Index measures how effectively time is being spent. SPI is calculated by dividing the Earned Worth (EV) of labor accomplished by the Deliberate Worth (PV).

- Estimate to Full (ETC): ETC forecasts the anticipated value to finish the remaining venture work. It helps venture groups decide how far more funding is required, both by subtracting precise prices from the EAC or via a brand new bottom-up estimate.

- Precise Value (AC): AC represents the full value incurred for accomplished work as much as a selected time limit. It’s utilized in Earned Worth Administration to evaluate how a lot has been spent in comparison with the worth of the work carried out.

- Finances at Completion (BAC): BAC is the full finances initially authorised for the whole venture. It serves because the monetary baseline and is used to measure value efficiency and forecast deviations from deliberate expenditures all through the venture life cycle.

- Earned Worth (EV): EV is the budgeted worth of labor truly accomplished at a given time limit. It quantifies progress in monetary phrases and is important for calculating value and schedule efficiency in Earned Worth Administration.

- Deliberate Worth (PV): PV is the licensed finances assigned to scheduled work. It displays how a lot of the finances ought to have been spent primarily based on the venture schedule and is used to judge whether or not the venture is on monitor.

Extra Estimate at Completion Formulation

Estimates at completion will also be calculated in three different methods, and every of the variations is finest for a sure state of affairs.

This formulation ought to be used when the distinction between the estimated finances and precise prices shall be totally different sooner or later than it’s within the current:

Estimate at Completion = Precise Value + (Finances at Completion – Earned Worth)

This formulation is the only option when manufacturing has been regular and issues are operating easily. Utilizing this formulation helps verify {that a} venture is on monitor to remain inside finances:

Estimate at Completion = Precise Value + (Finances at Completion – Earned Worth)

When it’s essential to take venture schedule and price efficiency into consideration (how effectively money and time are getting used) to revise a finances, use this formulation to seek out estimates at completion. As you may see, you first have to calculate the Schedule Efficiency Index and Value Efficiency Index.

Estimate at Completion = Precise Value + (Finances at Completion – Earned Worth) / Schedule Efficiency Index + Value Efficiency Index

The best way to Calculate Estimate at Completion: Estimate at Completion Formulation

Listed here are the formulation used to calculate the estimate at completion of a venture. Every of them permits venture administration groups to estimate how a lot a venture will value on the finish, however are barely totally different to accommodate varied eventualities.

1. EAC = BAC/CPI

We’re comfortable to report that probably the most generally used estimate at completion formulation is pretty easy! To be able to calculate the estimate at completion (EAC), it’s essential to know the finances at completion (BAC) and the fee efficiency index (CPI). With this data, the calculation is so simple as dividing the 2.

Under is what that estimate at completion formulation appears to be like like in additional element:

Estimate at Completion = Finances at Completion / Value Efficiency Index

This formulation assumes that the fee efficiency seen to date will proceed all through the remainder of the venture. It’s used when the venture is secure and traits in value effectivity are anticipated to stay constant.

As a result of it straight elements within the Value Efficiency Index (CPI), it’s finest for tasks with predictable spending patterns and no main disruptions. It permits groups to regulate expectations with out re-estimating every job, making it preferrred for constant, ongoing efficiency analysis.

2. EAC = AC + (BAC – EV)

This formulation is the only option when manufacturing has been regular and issues are operating easily. It assumes that previous value overruns or inefficiencies have been one-time occasions, and the remaining work shall be accomplished as initially budgeted. It’s most helpful when early value variances will not be anticipated to proceed and the unique plan nonetheless holds for future work.

Under is what that estimate at completion formulation appears to be like like in additional element:

Estimate at Completion = Precise Value + (Finances at Completion – Earned Worth)

This formulation doesn’t alter for ongoing efficiency traits, so it’s finest used when there’s confidence that the baseline plan remains to be lifelike. It’s a conservative forecast primarily based on reverting to the preliminary finances.

3. EAC = AC + [(BAC – EV) / (CPI × SPI)]

This estimate at completion formulation ought to be used when it’s essential to take venture schedule and price efficiency into consideration (how effectively money and time are getting used) to revise a finances.

It adjusts for each value and schedule efficiency, assuming that future work shall be influenced by present inefficiencies in each areas. It’s particularly helpful for troubled or complicated tasks the place delays and overspending are occurring collectively.

Under is what that estimate at completion formulation appears to be like like in additional element:

Estimate at Completion = Precise Value + [(Budget at Completion – Earned Value) / (Schedule Performance Index * Cost Performance Index)]

By incorporating each the Value Efficiency Index (CPI) and the Schedule Efficiency Index (SPI), it produces a extra complete forecast. It’s finest used when neither value nor time traits could be ignored, and restoration requires simultaneous consideration to each elements.

4. EAC = AC + Backside-up ETC

This method assumes that the unique plan is not legitimate, and a brand new estimate have to be constructed from the bottom up. It’s used when vital adjustments in scope, sudden challenges, or shifts in venture path happen.

Under is what that estimate at completion formulation appears to be like like in additional element:

Estimate at Completion = Precise Value + Backside-up Estimate to Full

As an alternative of counting on efficiency indices, this methodology entails an in depth reassessment of remaining duties and prices. It’s finest for tasks requiring a contemporary monetary outlook as a result of poor preliminary planning, altering necessities, or disrupted efficiency metrics that render earlier estimates unusable.

Estimate at Completion Instance

For this instance, we’ll use the primary Estimate to Full formulation variation. As a reminder, right here’s what that equation appears to be like like:

EAC = BAC / CPI

On this situation, the Finances at Completion (BAC) is $50,000 and the present Value Efficiency Index (CPI) is the same as 0.8. Due to this fact, we should divide $50,000 by 0.8.

EAC = $50,000 / 0.8

EAC = $62,500

This end result signifies that on the present second, the venture is estimated to value $62,500, which is $12,500 over the preliminary finances.

Estimate at Completion vs. Estimate to Full

These two phrases are sometimes combined up, as a result of they each check with estimates on some facet of a venture finances. As a result of they’re so simply confused, it’s key to know the distinction and when to calculate for which.

Estimate at completion (EAC) predicts complete prices, whereas estimate to finish (ETC) predicts the cash a venture nonetheless wants. ETC is the forecast of all further cash required to finish a venture. It doesn’t account for cash already spent.

Estimate at Completion vs. To Full Efficiency Index (TCPI)

The time period “to finish efficiency index” (TCPI) refers to how cost-efficient the remainder of a venture have to be with a purpose to full the ultimate deliverable. This can be a subset of a value efficiency index (CPI). A CPI exhibits how effectivity prices and sources are getting used within the current.

After we remedy for CPI, the reply shall be much less, higher or equal to at least one, relying on how prices examine to the quantity of labor accomplished.

If, as an example, CPI is lower than one, adjustments have to be made with a purpose to be extra cost-efficient. When that is the case, you’ll remedy for TCPI to discover a numerical worth representing how a lot this adjustment must be.

That formulation appears to be like like this:

TCPI = (Finances at Completion (BAC) – Earned Worth (EV)) / (BAC – Precise Value (AC))

Why Is it Vital to Calculate the Estimate at Completion of a Challenge?

Even probably the most well-planned budgets aren’t at all times 100% correct. Initiatives are vulnerable to adjustments and sudden circumstances, together with elevated or decreased bills and prices.

Calculating EAC provides venture managers the chance to trace precisely how a lot a change will affect the full finances — in a greenback quantity. Realizing this precise greenback quantity makes for higher, extra knowledgeable decision-making.

When to Calculate the Estimate at Completion of a Challenge

Estimate at completion is a way of estimating how a lot a venture will value on the finish of the road. However, with a purpose to precisely calculate for EAC, it’s essential know the fee efficiency index (CPI). As such, EAC can solely be calculated when a venture is operating.

The CPI is calculated at common intervals throughout a venture, as this quantity exhibits spending effectiveness. This makes it a very good behavior to calculate for EAC anytime the CPI adjustments.

Challenge Finances Template

Earlier than you calculate EAC, you’ll have to create an intensive venture finances. This free venture finances template for Excel lets you record all of your venture duties and their associated prices resembling labor, materials and tools. The perfect half is that it mechanically calculates the distinction between deliberate and precise prices to let you already know whether or not your venture is over or below finances.

Nevertheless, whereas this venture administration template is beneficial, it will possibly’t compete with the options of a sturdy venture administration software program like ProjectManager.

How ProjectManager Helps with Value Estimating and Variance

Whenever you’ve efficiently calculated the Estimate at Completion, it’s time to place the outcomes to make use of. To be able to make the most effective estimates, it’s essential have probably the most present data. The ProjectManager dashboard updates in real-time, so there’s no probability of utilizing outdated information to make vital choices for the longer term.

Use a variety of filters to customise the dashboard view to your liking and hone in on the essential particulars. See prices, duties, time spent and total venture well being, all from one hub.

Let your dashboard do the calculations for you and simply examine issues like deliberate v. precise prices, deliberate completion v. precise completion and extra. Which means there’s no have to get out the calculator or depend on third-party functions to see issues like your EAC.

Associated Content material

When creating an estimate at completion on your venture, you want the most effective instruments to calculate value estimations and variance. ProjectManager is a cloud-based venture administration software program with dashboards and useful resource administration options that offer you management over your venture prices. Attempt ProjectManager right now without spending a dime!