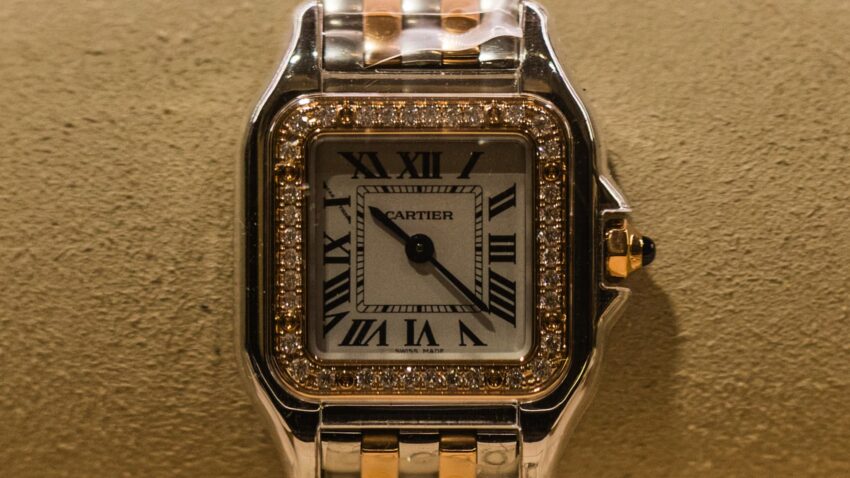

A Cartier de Panthere wristwatch on show at a Cartier luxurious items retailer, operated by Cie. Financiere Richemont.

Bloomberg | Getty Photographs

Cartier proprietor Richemont on Friday posted better-than-expected fiscal fourth-quarter gross sales, because the wealthiest spenders continued to shrug off world macroeconomic uncertainty.

Revenues on the Swiss luxurious group rose 7% year-on-year at fixed trade charges to five.17 billion euros ($5.79 billion) within the three months to the tip of March, above the 4.98 billion euros forecast by analysts in an LSEG ballot.

Shares closed up 6.9%. London time to commerce on the prime of the Stoxx 600.

The fourth-quarter gross sales bump was led by double-digit progress on the group’s Jewelry Maisons division, which incorporates Cartier, Van Cleef & Arpels and Buccellati.

Gross sales however declined inside the firm’s specialist watchmakers section, which options manufacturers Piaget and Roger Dubuis, led by weak spot within the Asia-Pacific area.

Full-year gross sales rose 4% to 21.4 billion euros, up on the earlier 12 months and simply forward of analyst expectations of 21.34 billion euros.

Gross sales rose yearly throughout all areas, besides Asia Pacific (ex. Japan) — the corporate’s largest market — the place declines had been led by a 23% drop in China. Japan led annual gross sales progress, up 25% at precise trade charges, buoyed by “sturdy home and vacationer spend” and a weak Japanese Yen.

“The Group’s efficiency was sturdy general, pushed by outstanding progress at our Jewelry Maisons and retail, and improved momentum at our ‘Different’ actions,” Richemont Chairman Johann Rupert stated in a press release. The corporate’s so-called “different” section contains its pre-owned watch retailer Watchfinder & Co.

The chairman however added that ongoing world uncertainties would proceed to require “sturdy agility and self-discipline.”

BofA World Analysis stated in a word final week that Richemont faces three key world headwinds: gold costs, U.S. tariffs and international trade fluctuations, by the use of the energy of the Swiss Franc and the weak spot of the U.S. greenback.

Nonetheless, the financial institution’s analysts added that the corporate’s pricing energy might present a tailwind.

“We expect value will cowl half the headwinds,” they wrote. “Pricing, product combine and better capability utilization are the obvious offsets.”

Richemont had beforehand reported its “highest ever” quarterly gross sales determine in January at 6.2 billion euros, whilst China demand weighed.

The earnings had, on the time, been taken as a sign of a wider turnaround within the beleaguered luxurious sector. Nonetheless, the specter of U.S. commerce tariffs and subsequent macroeconomic uncertainty have threatened to as soon as once more hit client confidence and discretionary spending globally.